Despite the fact that electronic signatures have been around for some time, the lack of clarity in the law resulted in discouraging some investment firms from implementing them and significantly improve their subscription process.

Obsidian

Recent Posts

Key industry guidelines & regulatory updates that support e-signatures

The Canadian Capital Market has been opening up towards usage of e-signatures from a regulatory perspective, with the goal to get digital all out.

Topics: Smartdocs, e signatures

Did you know that in the Canadian Capital Markets, for every dollar that comes in $3 are left on the table?

Topics: Smartdocs, e signatures

Here is the overview of Q&As from our recently held webinar "IIROC endorses e-signatures: What this means for your retail business?".

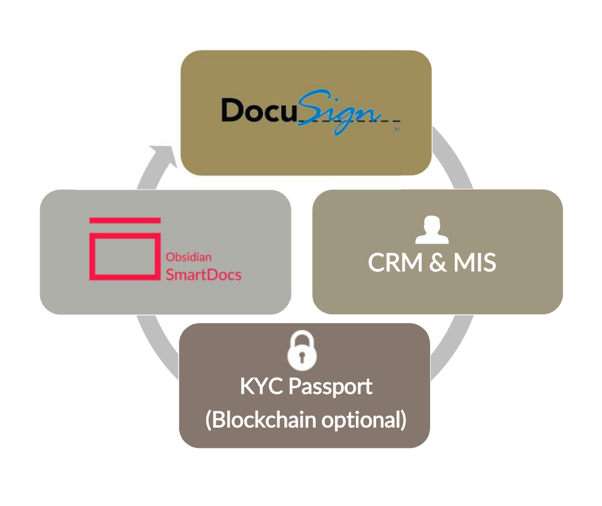

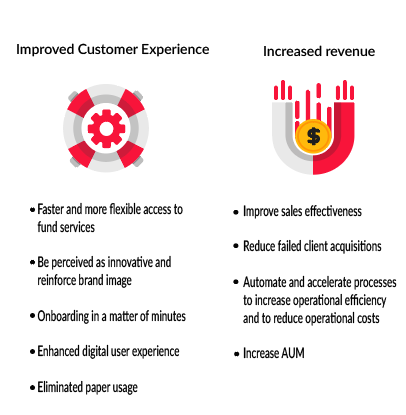

The investment management landscape is constantly changing, allowing the modernization of key processes. Latest regulatory updates and new technologies will a have huge impact on the automation of key processes, improving investors’ and advisors’ experience, and forward-thinking companies that adopt them in time will gain a significant competitive advantage.

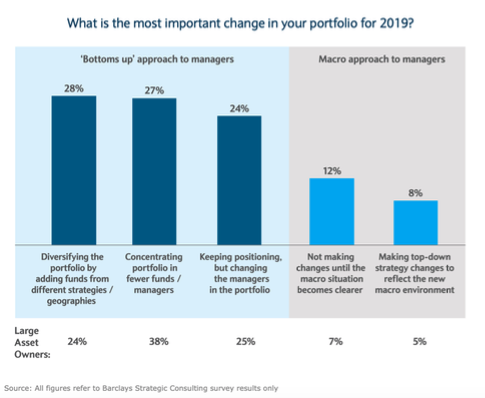

Barclays Investment Bank: 2019 Global hedge fund industry outlook

The Barclays Capital Solutions team in a recent study explored opportunities for the global hedge fund industry in 2019. Even with the shifting trends in relationships towards hedge funds, the bank believes that investors will remain committed to them. The infographic below, published by Barclays, shows the investors’ global hedge funds priorities for 2019.

AIMA WEBINAR: IIROC endorses Electronic signatures - What this means for your retail business

SUMMARY

The subscription document is effectively the point of sale for alternative investment managers, and historically, a recognized pain point across the industry. With new regulation opening up the doors to new technology, most firms are actively investing in digitizing on-boarding in order not to be left behind.

Revolutionizing the investor experience: Increase revenue by adopting digital signatures

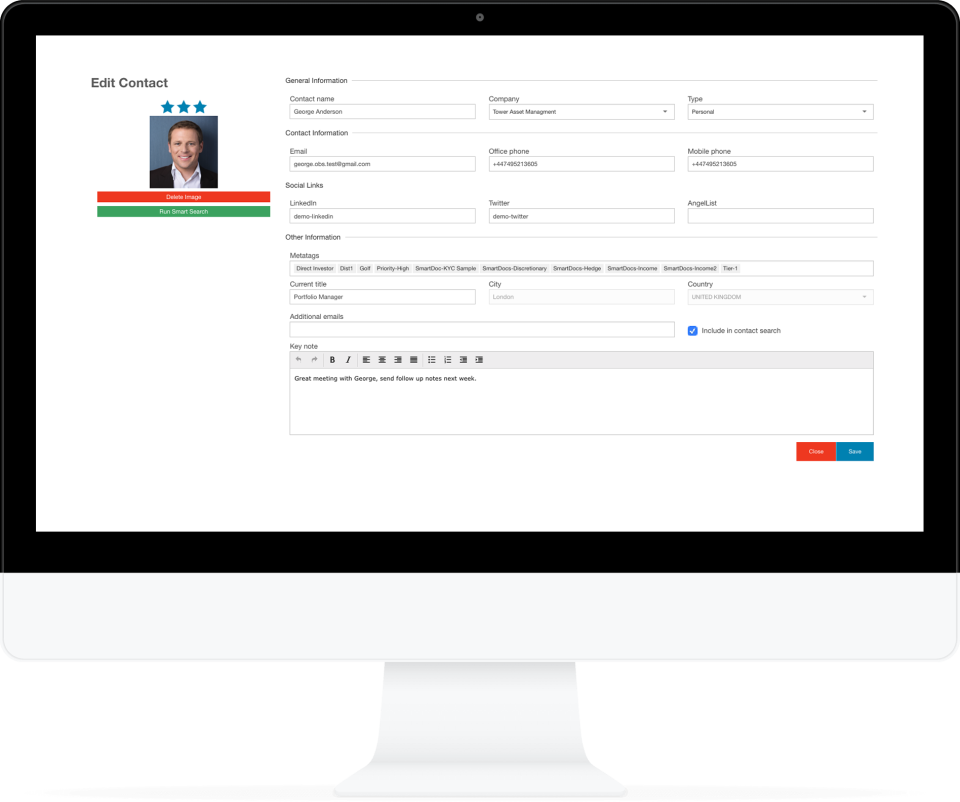

Investment firms that engage in providing traditional investor processes will most commonly require a combination of paper documentation, back-and-forth emails and in some cases, face-to-face meetings. Once the desired information is collected, it must then go through the highly manual process of being entered in to an organization’s internal system.

In the current environment, the investment management industry is facing the pressures of new regulations and lower fees, asset managers are looking for the best-of-breed technological solution to overcome those challenges and stay ahead of the competition, Clear Path explained in their latest report.